Motorcycle Registration Process

Motorcycle Registration Process

1. Application paper with the signature and completely filled up from the owner and importer/ dealer (H form). In case of company authorization signature and stamp of authorized executive; if that motorcycle is related with any bank or that kind of organization then and application paper to the authority and that must be in the official pad paper.

2. Recently taken 3 copy stamp size photos. ( Only for personal ownership)

3. Bill of entry; invoice; bill of lading and LCA copy ( in case of Photocopy then it must be attested from the showroom owner or the importer)

4. Sell certificate/ sell intimation/ proof paper of the sell. ( provided by importer and provider)

5. Packing list, delivery paper and gate pass (Only for CKD motorcycles)

6. A. VAT-1 ( If applicable), B. VAT-11(A) if applicable, C. payment recite of VAT (If applicable)

7. For CKD motor vehicles typed permission from BRTA and included permissions list.

8. Recite of Registration fee.

9. For the personal ownership National ID card/ Passport/ Telephone bill/ electricity bill/ etc attested photocopy and if the owner is an organization then a letter in their pad paper.

10. For 125cc motorcycles or over than that and affidavit on TK50 non judicial form stamp. (Sample is given at the website)

B. Registration fee:

If the engine capacity is 100cc or bellow and the weight is 90 KG or less than that.

1. Registration fee- TK 4830 ( Including VAT)

2. Retro reflective number plate- TK 2260 (including VAT)

3. Digital registration certificate- TK 555 (including VAT)

4. Motorcycle observing fee- TK 518 (including VAT)

5. Road tax (First two years )- TK 1150 (including VAT) and overall- TK 9313

If the engine capacity is over than 100cc and the weight are less than 90 or the same.

1. Registration fee- TK 6440 ( Including VAT)

2. Retro reflective number plate- TK 2260 (including VAT)

3. Digital registration certificate- TK 555 (including VAT)

4. Motorcycle observing fee- TK 518 (including VAT)

5. Road tax (First two years )- TK 1150 (including VAT) and overall- TK 10923

N.B: After every two years road TAX must be submitted for the remaining eight years and every time the payment amount will be TK 1150 and overall amount will be 1150x4= TK 4600. But there is an option to pay all the money at once for ten years and that amount is TK 5750.

If the engine capacity is 100cc or bellow and the weight is more than 90 KG.

1. Registration fee- TK 4338 ( Including VAT)

2. Retro reflective number plate- TK 2260 (including VAT)

3. Digital registration certificate- TK 555 (including VAT)

4. Motorcycle observing fee- TK 518 (including VAT)

5. Road tax (First two years )- TK 2300 (including VAT) and overall- TK 10463

If the engine capacity is more than 100cc and the weight is more than 90 KG.

1. Registration fee- TK 6440 ( Including VAT)

2. Retro reflective number plate- TK 2260 (including VAT)

3. Digital registration certificate- TK 555 (including VAT)

4. Motorcycle inspection fee- TK 518 (including VAT)

5. Road tax (First two years )- TK 2300 (including VAT) and overall- TK 12073

N.B: After every two years road TAX must be submitted for the remaining eight years and every time the payment amount will be TK 2300 and overall amount will be 2300x4= TK 9200. But there is an option to pay all the money at once for ten years and that amount is TK 5750.

C. The motorcycle must be available for inspection.

Is this tips helpful?

Rate count: 56Ratings:

New Added Bikes

Bike Tips

Rust in bike fuel tanks is a common problem, especially in humid climates or when the bike is not used for a long time. Detailed...

English BanglaThe ECU, or Engine Control Unit, is an electronic device that controls and manages various engine functions of a motorcycle. It ...

English BanglaOne of the most in-demand features in modern motorcycles is the Slipper Clutch.A Slipper Clutch is a special type of clutch syst...

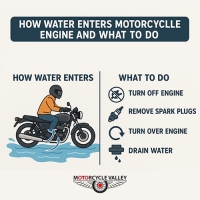

English BanglaDue to ongoing heavy rainfall, floods, and water logging in various parts of the country, there is a significant risk of water...

English BanglaIf you ride a bike, regular maintenance is a must—but during the monsoon, it requires extra care and attention. Rain, mud, a...

English Bangla